The Tax Cuts and Jobs Act (TCJA) of 2017 brought a lot of changes to the tax law. The tax reform went into effect in 2018. The first tax returns affected by the reform will be filed by April 17, 2019. There are some major changes you should be aware before you file your personal income taxes.

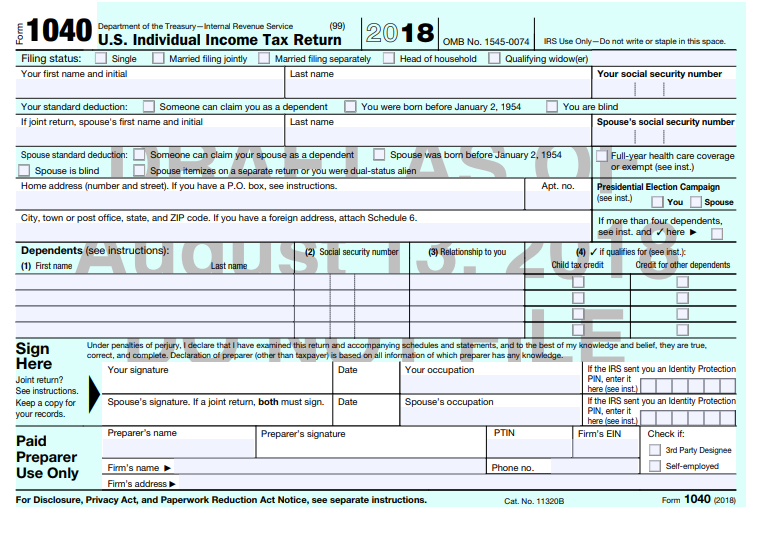

1- New Form 1040: Forms 1040A and 1040EZ have been eliminated. In an effort to streamline the processing of the returns, Form 1040 has been redesigned to a considerably shorter format and new Schedules 1 thru 6 have been introduced.

2- Standard deduction increased: In 2018, the standard deductions were almost doubled the amounts in 2017.

2018 Standard Deductions

Single/ Married Filing Separately………………………… $12,000

Head of Household…………………………………………….. $18,000

Married Filing Jointly…………………………………………. $24,000

Most people will not need to itemize their deductions unless above the aforementioned amounts.

3-Personal exemption eliminated: The $4,050 exemption for yourself, your spouse or dependents went away.

4-Child Tax Credit expanded: For every qualifying child, the CTC increased from $1,000 to $2,000.

5-New Credit for other dependents: You may be able to claim a new dependent credit of $500 for your children age 17 or over, children with ITINs and other relatives.

6-ACA Individual Mandate repealed: No more tax penalty if you choose not to carry health insurance in 2019. But for 2018, you are still going to have to pay the penalty if you did not have insurance for the whole year.

7-Changes in home mortgage interest: If you bought a home before December 15, 2017, you still get to deduct mortgage interest on up to $1,000,000. If you bought after that date, interest deduction was reduced to up to $750,000.

Home equity loans interest remains deductible as long as the loan amount is used to buy, build or substantially improve your house. It is not deductible if it is used, for example, to buy a car or reduce credit card debt.

8-Donations increased: If you itemize, charitable contributions limits were increased from 50 percent to 60 percent of your adjusted gross income.

9-Miscellaneous deductions suspended: The TCJA eliminated job related expenses and other miscellaneous itemized deductions that exceeded the 2 percent of your AGI. Items not longer deductible: uniforms, union dues, tax preparation fees and investment expenses.

10- Lower tax rates: The majority of the tax rates were lowered and the income thresholds were widened. The 2018 tax rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. More people will pay less tax for their taxable income.

In Conclusion:

Some taxpayers may get a larger refund because of the increased child tax credit and standard deduction. Others may break even because of the elimination of the personal exemption. Consult your tax preparer or email us to schedule a personal appointment.