TCJA

Select Category

Reforma tributaria para negocios

La Ley de Empleos y Reducción de Impuestos (TCJA) del 2017 fue promulgada con el próposito de fomentar el crecimiento económico y estimular las inversiones de negocios. Todos los dueños …

Tax reform for business owners

The Tax Cuts and Jos Act of 2017 (TCJA) was enacted with the intention of spurring economic growth and stimulating business investments. All business owners will see changes in their …

Child Tax Credit : good news, bad news

Families have come accustomed to rely on different credits based on qualifying children to increase their annual tax refunds. The credits were created for that same reason, to help economically …

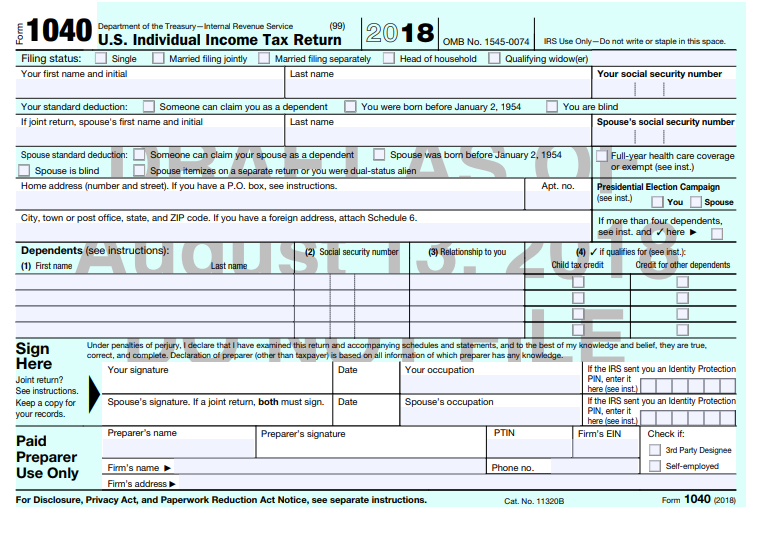

10 key changes you should know before you file your 2018 taxes

The Tax Cuts and Jobs Act (TCJA) of 2017 brought a lot of changes to the tax law. The tax reform went into effect in 2018. The first tax returns …

Read More… from 10 key changes you should know before you file your 2018 taxes