Blog

Select Category

Tackling Annoying Issues in QuickBooks Online

While QuickBooks Online (QBO) is a popular accounting software for small businesses and we certainly love it and recommend it, there are annoying issues or aspects of the platform that …

Read More… from Tackling Annoying Issues in QuickBooks Online

Utilizing Energy Credits to Power Up Your Tax Savings

By improving your home to be more energy-efficient, you could score a tax credit of up to $3,200. You’ve got until 2032 to claim that credit for any upgrade you …

Read More… from Utilizing Energy Credits to Power Up Your Tax Savings

Cómo reportar cuentas bancarias y financieras en el extranjero

Las personas en Estados Unidos mantienen cuentas financieras en el extranjero por diversas razones legítimas, como conveniencia y acceso a servicios financieros internacionales. Sin embargo, es crucial cumplir con el …

Read More… from Cómo reportar cuentas bancarias y financieras en el extranjero

15 Questions to ask a Tax Preparer

Lately I have been helping a large number of customers that had their previous year returns prepared by a less than honest tax professional. The experience led me to brainstorm …

15 Preguntas para Elegir a un Preparador de Impuestos

Ultimamente me han llegado varios clientes con problemas de impuestos causados por el preparador de impuestos anterior. Esta situación lamentable me hizo pensar cómo podría ayudar a otras personas antes …

Read More… from 15 Preguntas para Elegir a un Preparador de Impuestos

You should be using two factor authentication

For small business owners, the risk of data breaches and fraud is high, so taking all the necessary steps to protect your sensitive data is a must. Unfortunately for many …

Read More… from You should be using two factor authentication

What to do if you get audited by IRS

No business owner looks forward to a letter from the taxman requesting a closer look at the books. If you’ve received an audit letter – an official request by IRS …

Top 15 reasons small businesses implement an ERP system

Most small business owners are familiar with the concept of an ERP software system. It is traditionally seen as a large, costly, and complex software system that can take months …

Read More… from Top 15 reasons small businesses implement an ERP system

6 Proven Ways to Improve Your Content Writing

When it comes to writing for blogs, not all content is created equal. Many articles are rushed, poorly written, and lack the research to back them up, all of which …

Read More… from 6 Proven Ways to Improve Your Content Writing

Best Books for the Business Owner’s library

Bookstores and libraries around the world supply excellent instructional materials. Riding in the car or traveling on airplane, you can learn from experts. The bestseller lists at Amazon are fantastic …

How to Avoid Costly Inventory Problems

Inventory is the lifeblood of your business. It is the largest asset on your balance sheet and your company’s biggest revenue-generator. It goes without saying that poorly managed inventory can …

Benefits of using technology

These days, you can use technology to take care of almost any issue facing your business. If you have a task you don’t like to do, there’s an app or …

Separating personal and business expenses

There are some things in life that go together well and others that definitely do not. Business and personal finances are in the category of items that should not be …

10 Money-Saving Tips for Freelancers

While working at home as a freelancer sounds like the ultimate dream for anyone who tires of the rat race, freelancers still have more than their fair share of financial …

Strengthening your balance sheet

Your balance sheet (now more correctly called a Statement of Financial Position) reveals a great deal about your business, including the total value of your assets – the things you …

How Accounting Software Can Increase Profits

Most small business owners who use accounting software quickly master the basics. They automate processes like invoicing and payroll, track expenses and view real time financial reports to manage cash …

Read More… from How Accounting Software Can Increase Profits

Tax tips for new business owners

Want to avoid paying more than you should come tax time? Or a frantic last minute search for missing financial records? New business owners have a lot on their plate, …

4 Tips for Getting Your Business Through Tough Times

If you’re a small business owner whose company hasn’t gone through hard times, that’s great but it’s likely to happen at some point. As much as we dream about being …

Read More… from 4 Tips for Getting Your Business Through Tough Times

10 Productivity Tools to Help You Do More at Work

In today’s fast-paced world, everyone wants to be more productive. Fortunately, there is an ever-increasing number of tools, many of them available online and across multiple devices, that promise to …

Read More… from 10 Productivity Tools to Help You Do More at Work

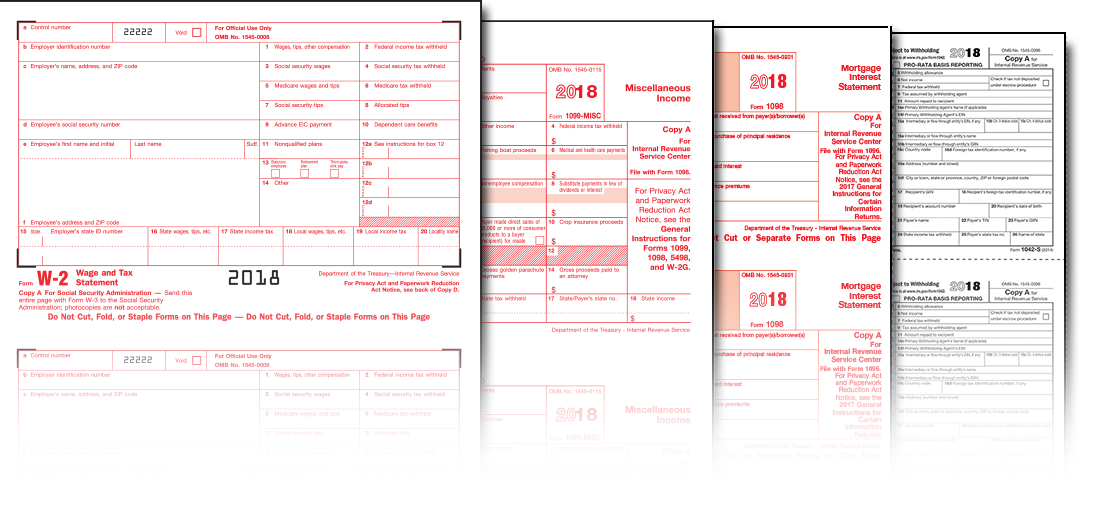

¡No he recibido todos mis documentos!

Se acerca el 15 de abril y todavía no ha recibido todos los documentos que le pide el CPA para terminar su preparación de impuestos. A continuación algunos de los …